BYD, Geely, And VinFast Are Fighting Over A Car Factory In Mexico

Happy Thursday! It's February 12, 2026, and this is The Morning Shift — your daily roundup of the top automotive headlines from around the world, in one place. This is where you'll find the most important stories that are shaping the way Americans drive and get around.

In this morning's edition, we're looking at a bidding war over a Mexican auto plant, and how the basics of supply and demand work for cars. We'll also look at Nissan's cost-cutting measures, and Mercedes' 2025 year-end numbers.

1st Gear: BYD, Geely, and Vinfast all want to be Mexico's next automaker

Mercedes-Benz is unloading a factory in Mexico, meaning some lucky company can pick up a new manufacturing plant. But who will it go to? Well, it seems there are three companies looking to make a foothold in Mexico: BYD, Geely, and VinFast. From Reuters:

Two of China's leading automakers, BYD and Geely, are among the finalists vying to purchase a Nissan–Mercedes-Benz plant in Mexico, according to a person familiar with the matter, as China seeks a manufacturing foothold in a country where U.S. tariffs are fueling factory closures and layoffs.

The finalists emerged from nine companies expressing interest in acquiring the factory, including at least two other major Chinese manufacturers: Chery and Great Wall Motor, according to two sources familiar with the matter. Vietnamese electric-vehicle maker VinFast is the third finalist, one of the people said.

The interest from Chinese automakers, which has not been previously reported, heralds a potentially major shift in Mexico's car industry. For decades, U.S., European and Japanese automakers have dominated, mostly building U.S.-bound vehicles.

Now, Mexican officials face a balancing act. Trump administration tariffs are battering Mexico's auto sector, and Chinese investment could generate much-needed jobs. But Mexican officials also fear that Chinese production in Mexico could inflame Washington and jeopardize this year's North American trade-agreement negotiations.

I don't envy Mexico's position here. Its auto industry could really use the help of massive companies like BYD and Geely, but the last thing the country needs is the Eye of Sauron in the White House to turn on it once again. VinFast, by contrast, wouldn't help the country as much but would likely draw less U.S. ire. Probably. Honestly, who knows what Trump will be upset by any more.

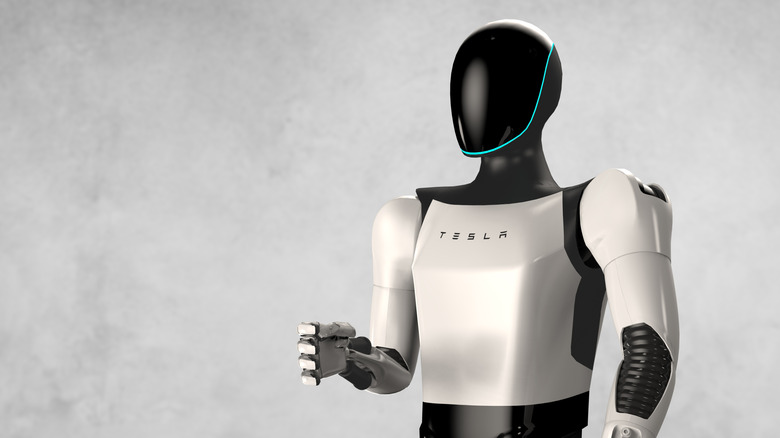

2nd Gear: No one's really sure how to sell cars once robots take manufacturing jobs

Automakers love robots, because they don't demand "paychecks" and "healthcare" and "sick days" like human workers do. That's why the companies are so bullish on robotics, because the market stands to be a cost-savings for their manufacturing lines. The problem is that all those replaced workers won't exactly have the cash to buy cars any more. From Automotive News:

According to analysts at Gartner and Warburg Research, at least one automaker will achieve 100 per cent assembly automation by 2030.

A U.S. or Chinese automaker will likely be the first to create a 100-per-cent assembly automation line "toward the end of this decade," as several players in those markets "are already setting up disruptive manufacturing processes and reveal more of a focus on humanoid robots," Gartner Vice-President of Research Pedro Pacheco told Automotive News Europe.

...

So it begs the question: If robots do all the work, who makes the money — and ultimately, who is left to buy the vehicles?"The world has changed a lot since the 1950s, but we still need jobs to be able to buy cars, and that's the reality of it," said [Unifor National President Lana] Payne, who represents 23,500 autoworkers in Canada. "And I think that this is the kind of paradox that underpins any kind of discussion around automation."

Markets run on supply and demand. An automaker that cuts its costs to nothing by replacing human workers with robots will have fantastic profit margins, but it's also going to make all its former workers too broke to buy cars — that's a pretty massive constraint on the demand side of the equation. If you've ever felt like the economy is a game of musical chairs, with no company wanting to be the single one left paying people when the AI-generated music stops, you might not be far off.

3rd Gear: Nissan cuts seven factories, 20,000 jobs to save cash

Nissan's big thing in 2025 was cost-cutting, under new CEO Ivan Espinosa. The company is now patting itself on the back for pulling that off after exiting seven factories and cutting 20,000 jobs. From Automotive News:

Nissan will finally exit all seven of the global assembly plants it has targeted for closure and is ahead of schedule in cutting some 20,000 jobs, CEO Ivan Espinosa said while announcing the rebounding Japanese automaker had whittled down its projected operating loss.

Nissan Motor Co. reached the key milestone last month in announcing it will sell its factory in South Africa to Chery, one of China's most successful international brands.

It completes a key stage in Nissan's cost-saving quest to shutter factories worldwide and slash fixed costs. The company has so far cut ¥160 billion ($1.04 billion) in ¥250 billion ($1.63 billion) of fixed costs targeted under the Re:Nissan revival plan that Espinosa unveiled last May.

We've already seen that cost-cutting result in Nissan selling a rebadged, decontented Mitsubishi, so it'll be interesting to see where the company goes next. There comes a point in saving money where you cheapen your brand beyond the point of recovery, and let's hope Nissan never gets there.

4th Gear: Mercedes profits for 2025 dropped thanks to tariffs

Tariffs have hit automakers across the world, and Mercedes-Benz is no exception. The company spent over a billion dollars on tariffs in 2025, and it's already predicting lower returns for 2026 thanks to their impact. From Automotive News:

Tariff costs for Mercedes-Benz amounted to about €1 billion ($1.2 billion) in 2025, contributing to a steep plunge in the automaker's full-year earnings.

Mercedes' operating profit more than halved to €5.8 billion ($6.9 billion) in 2025, hit by higher tariff costs plus difficulties in the cutthroat China market and negative currency effects.

"Amid a dynamic market environment, our financial results remained within our guidance, thanks to our sharp focus on efficiency, speed and flexibility," CEO Ola Kallenius said while announcing 2025 results Feb. 12.

Mercedes said the profit margin at its cars division could fall further this year, indicating tough months ahead. The division's adjusted return on sales is expected to be 3 percent to 5 percent in 2026, compared with 5 percent in 2025.

What will our impending financial meltdown do to demand for luxury vehicles with tariff-inflated costs? It seems like we'll find out.

Reverse: Inventor of furniture

He did all that for the American Revolution, and still had time to come up with the idea of chairs. What a guy.

On The Radio: Joywave - 'DESTRUCTION'

I'm honestly not sure how I haven't used this track as an On The Radio gear yet.